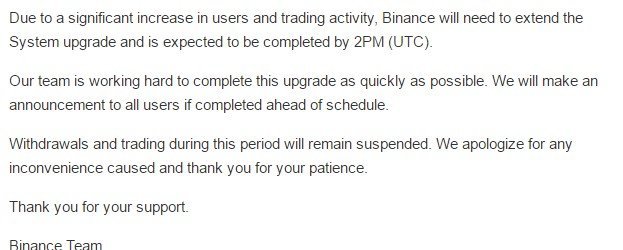

Rising debt is a reality for many Canadians, with levels reaching all-time highs in recent years. This trend, growing for over three decades, sees the average person owing more than $29,000, not including their mortgage. From buying a home to daily spending, Canadians are borrowing more than ever. This article breaks down the key factors behind this trend, what it means for your finances, and how you can stay in control.

Understanding the Scope of Canadian Household Debt

The numbers paint a clear picture of a nation taking on more financial obligations. According to the Bank of Canada, households collectively owed over $2 trillion at the end of last year. This isn’t a recent development but rather a consistent trend that has been building for more than 30 years.

A key indicator of this situation is the debt-to-income ratio. Stephen Poloz of the Bank of Canada explained it simply: “The average Canadian owes about $1.70 for every dollar of income he or she earns per year, after taxes.” This means that for many, debt payments are a significant portion of their take-home pay, leaving less room for savings or unexpected expenses.

Research from TransUnion further confirms this upward trend, showing that overall debt levels have continued to climb. This steady increase highlights a long-term shift in how Canadians are managing their money.

What are the Biggest Drivers of Debt?

While many factors contribute to household debt, a few key areas stand out as the primary drivers. Homeownership is overwhelmingly the largest contributor, but other expenses also play a significant role in the financial lives of Canadians.

Mortgages are the single biggest piece of the puzzle. They make up nearly three-quarters of the total $2 trillion household debt. As housing prices have continued to climb across the country, Canadians are taking on larger loans to enter the property market.

Other significant reasons for borrowing include:

- Auto Loans: The need for a vehicle for work or family life leads many to take on car loans.

- Consumer Spending: Credit card debt is on the rise, showing that daily spending habits are contributing to the problem.

- Life Expenses: As noted by loan providers like SkyCap Financial, many people also borrow for essential needs like healthcare, education, or costs associated with moving.

A Closer Look at Mortgages and Credit Cards

Mortgage and credit card balances are where the debt story becomes most personal for Canadians. The average mortgage debt now stands at an imposing $256,600. This large figure is a direct result of the high cost of real estate, forcing homebuyers to commit to decades of significant payments.

On the other end of the spectrum is credit card debt, which reflects day-to-day spending habits. The average Canadian carries a credit card balance of over $4,000. Financial experts point out a common trap: many people only pay the minimum required amount each month. This practice allows the balance to grow due to high interest rates, making it difficult to ever pay off the full amount while continuing to spend.

The Impact of a Changing Economy

The current debt levels could become a bigger issue as the economic climate shifts. Interest rates are expected to rise, which will directly impact anyone carrying a balance. For variable-rate mortgages and credit cards, this means higher monthly payments.

This will likely lead to an increase in delinquency rates, which is the percentage of people who are late on their payments. However, experts do not anticipate a catastrophic spike.

Regina Malina, a senior director at Equifax Canada, suggested the change will be gradual. “They’re just going to start inching up a little bit, probably not double digits,” she told the Financial Post. While this is reassuring, it still means more Canadians will struggle to keep up with their payments.

Simple Strategies to Manage and Avoid Debt

According to experienced loan providers like SkyCap Financial, preventing debt from spiraling out of control comes down to awareness and discipline. Consumers who understand the realities of credit are better equipped to avoid its pitfalls.

One of the most effective tools is creating and sticking to a budget. Knowing where your money is going each month helps identify areas where you can cut back. Another key strategy is to avoid impulse buys, which often end up on high-interest credit cards. By planning purchases and thinking critically about needs versus wants, you can keep unnecessary debt at bay.

Frequently Asked Questions about Canadian Debt

How much debt does the average Canadian have?

The average Canadian owes over $29,000 in non-mortgage debt. When including mortgages, the average mortgage debt alone is $256,600 for homeowners.

What is the main source of debt for Canadians?

Mortgages are the primary source of debt, making up almost 75% of the total $2 trillion owed by Canadian households. This is followed by consumer debt, including credit cards and auto loans.

What does a $1.70 debt-to-income ratio mean?

This ratio means that for every one dollar of disposable income a Canadian earns in a year, they owe $1.70 in debt. It is a key measure of how leveraged the average household is.

What are the best ways to avoid getting into debt?

Experts recommend creating a detailed budget to track your spending, avoiding impulse purchases, and building an emergency fund. Understanding how credit and interest work is also crucial to making informed financial decisions.

Leave a Comment