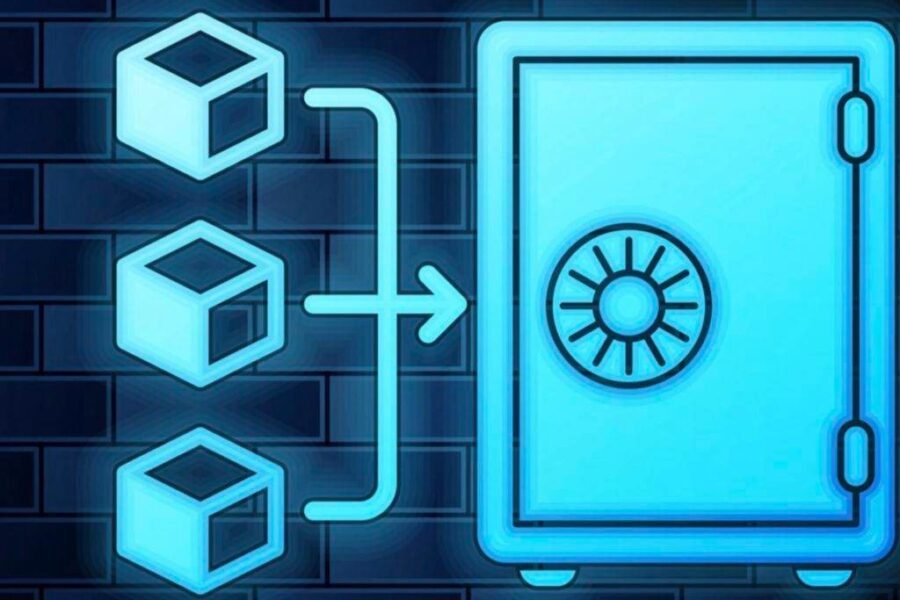

A Bitcoin wallet is a fundamental tool for anyone looking to use cryptocurrencies. It’s a software program that allows you to send, receive, and securely store your digital assets by interacting with the Bitcoin blockchain. Unlike a physical wallet that holds cash, a crypto wallet doesn’t store your coins directly. Instead, it holds the secret digital keys you need to access your Bitcoin address and sign transactions. This guide explains how they work and which type is right for you.

What Exactly is a Bitcoin Wallet?

A Bitcoin wallet is best understood as a personal interface to the Bitcoin network, much like an online banking app is an interface to the traditional banking system. It is a program that gives you complete control over your digital funds.

The software generates and stores your private and public keys, allowing you to interact with the blockchain. When you want to send Bitcoin, you use your wallet to sign the transaction with your private key, proving you own the funds you are trying to spend.

It’s crucial to understand that your Bitcoin is not stored “in” the wallet itself. Your coins exist on the blockchain, which is a global, public ledger. The wallet simply holds the essential keys that allow you to access and move those coins.

How Do Bitcoin Wallets Actually Work?

Every Bitcoin wallet relies on a combination of a private key and a public key. These two keys are cryptographically linked and are the foundation of your wallet’s security and functionality.

Think of your public key as your bank account number. You can share your public address (a shorter, hashed version of your public key) with anyone to receive Bitcoin without any risk.

Your private key, on the other hand, is like your bank account password or PIN. This key must be kept completely secret, as it grants the ability to spend the Bitcoin associated with your public address. Anyone who gets access to your private key has full control over your funds. Every transaction you make is a digital signature created by combining your private and public keys.

The Main Types of Bitcoin Wallets Explained

There are several kinds of Bitcoin wallets, each offering a different balance between security and convenience. The four main types cater to different user needs, from daily traders to long-term investors.

Choosing the right one depends on how you plan to use your Bitcoin.

- Desktop Wallets: These are installed directly on your desktop or laptop computer. They give you full control over your keys and funds, but they are only as secure as the computer they are on.

- Mobile Wallets: These run as an app on your smartphone, making them very convenient for spending Bitcoin in physical stores or on the go.

- Web Wallets: These are accessed through a web browser and often hosted by third-party services like cryptocurrency exchanges. They are the least secure because the third party typically controls your private keys.

- Hardware Wallets: These are small, physical devices that store your private keys offline, completely isolated from the internet. They are widely considered the most secure way to store cryptocurrency.

Generally, for small amounts used for daily spending, a mobile wallet is convenient. For large, long-term holdings, a hardware wallet is the gold standard for security.

Why are Hardware Wallets Considered the Safest Option?

Hardware wallets provide the highest level of security for your digital assets because they keep your private keys in “cold storage.” This means the keys are stored in a secure, offline environment.

When you want to make a transaction, you connect the hardware wallet to your computer or mobile device. The transaction details are sent to the hardware wallet, which signs it internally using your private key. Only the signed transaction is sent back to the computer, ready to be broadcast to the network.

Because your private keys never leave the secure hardware device, they are never exposed to your internet-connected computer. This makes them safe from viruses, malware, and phishing attacks that could otherwise steal your funds. Brands like Trezor and Ledger use a small display on the device so you can physically verify transaction details before approving them.

Popular Hardware Wallets on the Market

The hardware wallet market is dominated by a few key players known for their strong security and user-friendly designs. Trezor, Ledger, and KeepKey are some of the most trusted names available today. Each offers unique features, but all share the core principle of offline key storage.

The choice often comes down to specific coin support, budget, and personal preference for the user interface.

| Wallet | Key Feature | Connectivity | Common Models |

|---|---|---|---|

| Trezor | First-ever hardware wallet, open-source firmware | USB | Trezor One, Trezor Model T |

| Ledger | Uses a Secure Element chip for enhanced physical security | USB, Bluetooth (Nano X) | Ledger Nano S Plus, Ledger Nano X |

| KeepKey | Large display for easy transaction verification | USB | KeepKey |

Other innovative options exist, such as the Ellipal wallet, which is completely air-gapped and uses QR codes to sign transactions, avoiding any USB or Bluetooth connection.

Understanding Wallet Security and Recovery

One of the most important innovations in wallet technology is the deterministic or “HD” wallet. When you set up a modern wallet for the first time, it generates a single master key, known as a “seed.”

This seed is presented to you as a sequence of 12 to 24 simple English words. This is your mnemonic or recovery phrase. From this single seed, the wallet can generate an entire tree of key pairs and addresses.

This recovery phrase is the ultimate backup for your entire wallet. If your hardware wallet is lost, stolen, or destroyed, you can simply purchase a new compatible wallet and enter your 24-word phrase to restore full access to all your funds. It is vital to write this phrase down and store it in a safe, offline location where no one else can find it.

Common Security Risks to Avoid

While wallets provide security, users must remain vigilant against common threats. One major risk involves online accounts linked to your crypto services. Hackers often target your email account to reset passwords on exchanges and withdraw your funds.

Another serious threat is scams involving hardware wallets. Never use a wallet that comes with a pre-filled or “pre-scratched” recovery phrase. Scammers sell these devices, and since they already have a copy of the recovery phrase, they can steal any funds you load onto the wallet. Always initialize a new hardware wallet yourself to generate a fresh, unique recovery phrase.

Frequently Asked Questions about Bitcoin Wallets

What is the difference between a Bitcoin address and a private key?

A Bitcoin address is like your bank account number; it’s a public piece of information you can share with others to receive funds. A private key is like your secret PIN or password; it proves ownership and is used to sign transactions, so it must never be shared.

Are Bitcoin wallets anonymous?

Bitcoin wallets are pseudonymous, not completely anonymous. Your real-world identity is not directly linked to your wallet address. However, all transactions are permanently recorded on the public blockchain and can potentially be traced back to an individual through analysis.

What happens if I lose my hardware wallet?

If you lose your hardware wallet, your crypto is still safe as long as you have your recovery seed phrase. You can buy a new compatible wallet, enter your seed phrase during setup, and you will regain complete access to your funds.

Can I store different cryptocurrencies in one wallet?

Yes, most modern software and hardware wallets are multi-currency wallets. They allow you to store Bitcoin, Ethereum, and hundreds or thousands of other cryptocurrencies securely in a single application or device.

Is a wallet on a crypto exchange safe?

Using a wallet on a cryptocurrency exchange is convenient for trading but is considered less secure for long-term storage. The exchange controls your private keys, meaning you are trusting them with your funds. These platforms are often targets for large-scale hacks.

Leave a Comment