Cryptocurrencies offer exciting investment opportunities, but they also attract scammers. A crypto Ponzi scheme is a type of fraud that promises huge profits to lure in investors. The operators use money from new investors to pay earlier ones, creating a fake image of success until the entire system collapses. Knowing how to identify these scams is crucial for protecting your digital assets from disappearing overnight. This guide will walk you through the key warning signs.

What is a Crypto Ponzi Scheme?

A Ponzi scheme is a fraudulent investment plan named after Charles Ponzi, who ran a famous scam in the 1920s. In the crypto world, these are often called pyramid schemes. The core idea is simple: the organizers promise investors very high returns with little to no risk.

However, these returns are not generated from any legitimate business activity. Instead, the money from new investors is used to pay off the people who invested earlier. This creates a false illusion that the investment is profitable, which encourages more people to join.

The entire operation depends on a constant flow of new money. Once people stop investing, the scheme can no longer pay its promised returns, and it quickly falls apart. When it collapses, most investors, especially the newer ones, lose all of their money.

How these Fraudulent Schemes Operate

The operator of a crypto Ponzi scheme never has enough money to pay back everyone. As more investors join, the amount of money owed grows larger, making the scheme increasingly unstable.

They often use complex language or talk about a secret trading method to avoid explaining how they generate profits. The reality is that there is no secret method; the money is just being shuffled around between investors.

If you invest in one of these schemes, there is no guarantee you will ever see your money again. Even if you manage to pull your funds out before it collapses, you could still lose a portion of your initial investment. However, staying in until the end almost always results in a total loss.

Warning Sign 1: Focus on Hype, Not Real Value

One of the biggest red flags is when a project’s main selling point is how many people are investing or how high the returns are. Legitimate cryptocurrency projects focus on their technology, utility, and the real-world problem they are trying to solve.

Scammers, on the other hand, rarely talk about the fundamentals of their project. Their entire pitch revolves around guaranteed profits and creating a fear of missing out (FOMO). They emphasize recruitment and returns over actual cash flow or a sustainable business model.

A trustworthy crypto project will have a detailed whitepaper, an active development team, and regular updates. If a project has nothing to offer besides the promise of making you rich quickly, you should be very cautious.

Warning Sign 2: The Multi-Level Marketing (MLM) Disguise

Many crypto Ponzi schemes are structured like multi-level marketing (MLM) businesses. They don’t just ask you to invest; they heavily pressure you to recruit new investors into the scheme.

The operator might promise you commissions or bonuses for every person you bring in. This turns investors into unknowing recruiters for the scam. The system is designed this way to ensure a steady stream of new money to keep the scheme running.

You might be told to:

- Deposit a large amount of crypto to join a “special” investment tier.

- Invite your friends and family to earn extra rewards.

- Create social media content to promote the project.

This recruitment-based model is a classic sign of a pyramid scheme. Legitimate investments focus on the value of the asset itself, not on how many new people you can sign up.

Warning Sign 3: Promises of High Returns with No Risk

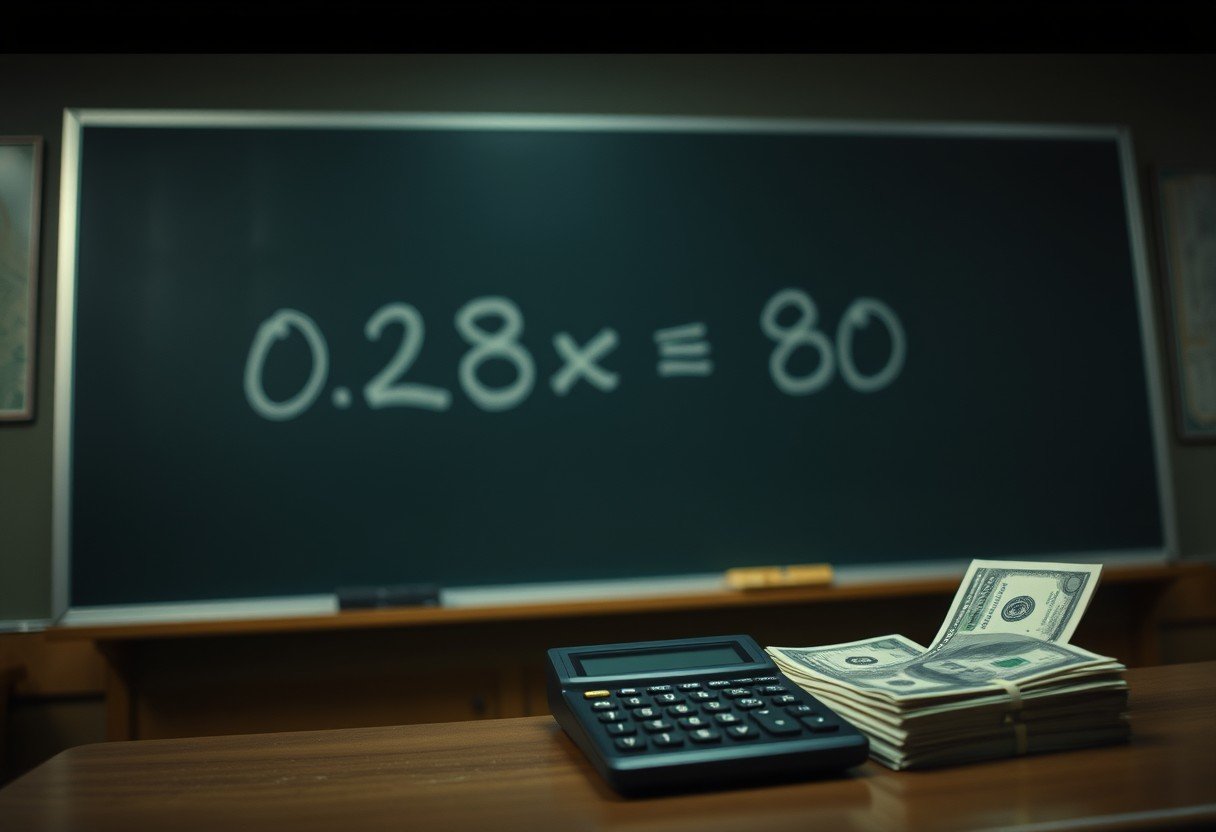

A core rule of investing is that high returns always come with high risk. If a crypto project promises you massive profits with little to no risk, it is almost certainly a scam. Scammers often advertise unrealistic yields, sometimes as high as 400% in a short period, to attract greedy or inexperienced investors.

They will ask you to trust them blindly rather than providing a clear, logical explanation of how they generate such incredible returns. When questioned, their answers are often vague, using technical jargon to confuse you.

Remember, if an investment sounds too good to be true, it probably is. There is no such thing as a guaranteed high-return, low-risk investment in the volatile world of cryptocurrency.

Warning Sign 4: Unregistered Projects and Lack of Transparency

Legitimate financial companies, including many crypto businesses, are required to register with government authorities like the U.S. Securities and Exchange Commission (SEC). Ponzi schemes almost always operate illegally without any proper registration.

These schemes are often run by anonymous teams, making it impossible to hold anyone accountable when the project collapses. They may also hide behind a front company that claims to sell a different product, while the investment scheme is the real focus.

Before investing, do your research to verify the project’s legitimacy. Below is a simple checklist to compare a real project with a potential scam.

| Feature | Legitimate Crypto Project | Potential Ponzi Scheme |

|---|---|---|

| Team | Public and verifiable identities | Anonymous or fake profiles |

| Whitepaper | Detailed, professional, and clear | Vague, plagiarized, or nonexistent |

| Business Model | Focus on technology and utility | Focus on recruitment and returns |

| Registration | Registered with relevant authorities | Unregistered and unregulated |

How to Protect Yourself from Crypto Scams

Protecting yourself from Ponzi schemes requires skepticism and thorough research. Rushing into an investment based on hype is the fastest way to lose money. By following a few simple steps, you can significantly reduce your risk of falling victim to a scam.

Here is a step-by-step guide to help you invest safely:

- Do Your Own Research (DYOR): Never invest based on a tip from a stranger or a social media post. Read the project’s whitepaper, understand its purpose, and research the team behind it.

- Be Skeptical of “Guaranteed” Returns: The crypto market is highly volatile. No one can guarantee profits. Be extremely wary of any project that claims otherwise.

- Check for Registration: See if the company is registered with a financial regulatory body in its country of operation. While this isn’t a guarantee of safety, a lack of registration is a major red flag.

- Understand the Source of Yield: If a project offers high yields, find out exactly how that yield is generated. If they can’t provide a clear and believable explanation, it’s best to stay away.

Frequently Asked Questions

What is the main difference between a crypto Ponzi scheme and yield farming?

A Ponzi scheme pays returns to earlier investors using capital from new investors, without any real underlying profit. Legitimate yield farming generates returns by providing liquidity to decentralized finance (DeFi) protocols, earning fees from transactions and other real economic activities.

Can you get your money back from a crypto Ponzi scheme?

It is extremely difficult and rare to recover money from a collapsed Ponzi scheme. The operators often disappear with the funds, and because many crypto transactions are irreversible, investors are usually left with a total loss.

Are all cryptocurrencies with high returns a scam?

Not necessarily, but extremely high returns always come with extremely high risks. Some new or small-cap cryptocurrencies can see massive gains, but they can also crash to zero. The key difference is that a scam promises high returns with no risk, which is impossible.

How do I check if a crypto project is registered?

You can check the online databases of financial regulators in the country where the project claims to be based. For example, in the United States, you can search the SEC’s EDGAR database. Be aware that many scams use fake registration details.

Leave a Comment