In a groundbreaking move for a small Pacific nation, the Marshall Islands is set to launch its own national digital currency, the Sovereign (SOV). This initiative, a world-first, aims to secure the country’s economic future as critical financial aid from the United States is scheduled to end. The SOV represents a radical shift, leveraging blockchain technology to create a new form of money independent of traditional banking systems.

A Bid for Economic Sovereignty

For decades, the Marshall Islands has used the U.S. dollar as its official currency, a symbol of its close ties with the United States. However, with a compact of free association that provides significant financial aid set to expire, the nation faces a looming economic cliff. This aid constitutes a large portion of its $115 million economy, which is primarily based on agriculture and light industry.

To navigate this challenge, the government passed the Sovereign Currency Act of 2018, laying the legal groundwork for the SOV. This new currency is not just a replacement for the dollar; it is a strategic step towards achieving full economic independence and creating a sustainable financial future for its citizens.

The introduction of the SOV is a bold experiment for a nation with a small but growing tourism sector. By creating its own money, the Marshall Islands hopes to control its economic destiny rather than remain dependent on external financial forces.

A Radical New Economic Model

The SOV is designed to be unlike any other national currency in the world today. It will be the first to implement a famous economic theory by Milton Friedman known as the K-percent rule. This means the money supply will grow at a fixed, predetermined rate that is publicly known.

This approach is a stark contrast to how major global currencies are managed. In most countries, a central bank committee decides on interest rates, which gives private banks significant power over how much money is created and circulated. SOV, however, will be the only currency in existence created exclusively by the government and not as debt by banks.

This fundamental difference dramatically reduces the influence of bankers over the nation’s money supply. While bankers can still create SOV-backed financial products, they must be redeemable for actual SOV held in reserve, ensuring the government maintains ultimate control.

| Feature | Sovereign (SOV) | Traditional Fiat Currency |

| Money Creation | Directly by the government | Primarily by commercial banks as debt |

| Inflation Control | Fixed, predetermined growth rate | Managed by central bank committees |

| Banker Influence | Radically reduced | Significant and direct |

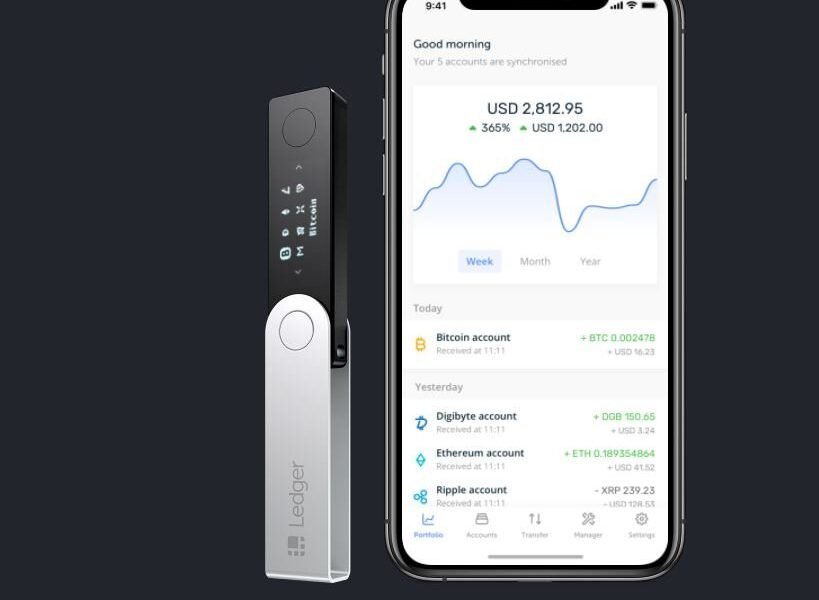

Powered by Ethereum’s Technology

The technological foundation of the SOV is just as innovative as its economic principles. The currency will be issued on the Ethereum network, one of the world’s most established and secure blockchain platforms. This makes the SOV a type of cryptocurrency known as an ERC20 token.

Building on Ethereum gives the SOV powerful, built-in features that traditional currencies lack. The most significant of these is the ability to use smart contracts. This technology allows for all kinds of automated and secure financial transactions without needing a middleman.

- Smart Contracts: Enables automated financial dealings, such as scheduled payments, trading, and the creation of future financial products like options.

- Decentralized Access: As an ERC20 token, SOV can be freely traded on decentralized crypto exchanges for other tokens, including Ether (ETH).

- Global Reach: The blockchain-based nature of SOV provides a transparent and accessible financial system.

This technological choice positions the Marshall Islands at the cutting edge of financial innovation, turning its remote location into a hub for digital finance.

Bridging the Gap between Crypto and Fiat

The Sovereign (SOV) is designed as a unique hybrid, created to exist in both the traditional financial world and the emerging crypto space. This dual nature is one of its most promising aspects.

On one hand, it will be a legal tender, a fiat currency that can be held by banks and other major financial institutions. This will allow it to be traded on the world’s large foreign exchange (forex) markets, just like the U.S. dollar or the Euro.

On the other hand, its blockchain-based identity allows it to be seamlessly traded within the cryptocurrency ecosystem. The creators of SOV envision it acting as a “Panama Canal” between the two financial worlds. This connection promises to bring more traffic and legitimacy to the crypto space while providing the traditional finance world with a regulated, government-backed digital asset.

Leave a Comment