Transitioning into adulthood brings financial independence, but also unexpected challenges. There might be times when you, as a young adult, face a cash shortfall and need to borrow money. Turning to family can be a great option, but it requires a careful approach to avoid awkwardness and preserve your relationships. Understanding how to ask responsibly is key to getting the help you need while maintaining everyone’s respect and trust.

First, Check All Your Other Options

Before you even think about asking your parents or other relatives for money, take a hard look at your own finances. Your family members, especially your parents, are likely focused on their own financial goals, like retirement. Approaching them should always be your last resort.

This shows them that you are a responsible adult trying to handle your own problems first. Try to solve part of the problem yourself. If you need money for a car repair, see if you can cover a portion of the bill with your current funds. Your family will be more willing to help cover a remaining balance than to foot the entire bill.

Exhausting all other avenues first proves that you aren’t just taking the easy way out. It shows maturity and respect for their financial situation.

Have a Clear and Honest Reason for the Loan

Once you’ve decided that borrowing from family is your only option, you need to be prepared to explain why you need the money. Vague requests can seem suspicious. Be specific and honest about where the money is going. Lenders, even family, are more likely to help if they understand the importance of the need.

Instead of just stating the item you want to buy, explain the benefit. Don’t just say, “I need money for a new laptop.” Instead, explain, “My current laptop is too slow for my new job, and a new one would significantly improve my productivity and help me work more efficiently from home.”

Being truthful is always the best policy, even if the reason is a bit embarrassing, like catching up on an electricity bill. Your family has empathy and will appreciate your honesty. Good reasons for a loan often include:

- Unexpected medical expenses

- Essential car repairs for commuting to work

- A security deposit for a new apartment

- Covering a temporary income gap between jobs

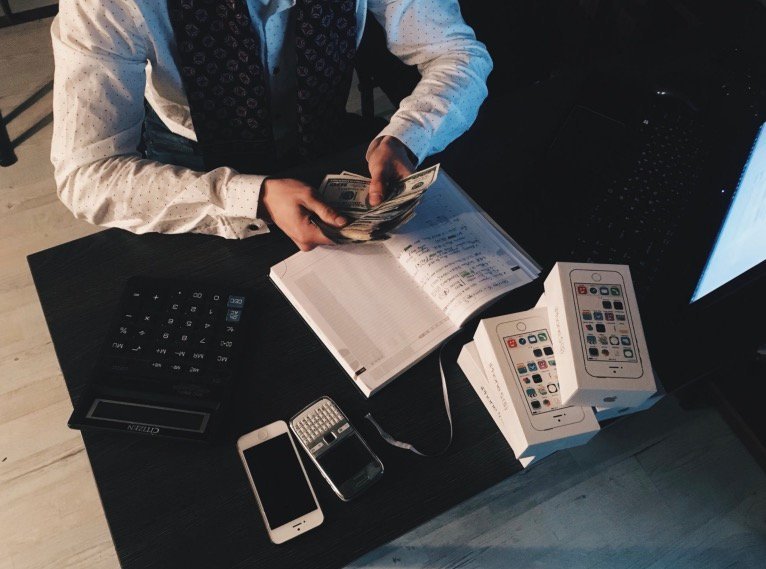

Avoid asking for money for non-essential items like vacations, expensive gadgets, or concert tickets, as this can make you appear financially irresponsible.

Ask for a Reasonable and Specific Amount

Don’t just pull a number out of thin air. Before you ask, create a simple budget to determine the exact amount you need. This demonstrates that you have thought through your situation carefully. Asking for a vague, large sum can make your family uncomfortable and feel like you’re taking advantage of them.

Request the specific amount required, perhaps with a small buffer for unexpected costs, and be ready to explain the breakdown. This transparency builds trust. Remember, your parents have their own bills and financial responsibilities. Being considerate of their budget is crucial for a positive outcome.

Here is a simple example of how you can break down your need:

| Expense Item | Estimated Cost |

|---|---|

| Rent Shortfall | $450 |

| Upcoming Utility Bill | $120 |

| Groceries for the Week | $80 |

| Total Amount Needed | $650 |

Propose a Realistic Repayment Plan

This is not a gift; it is a loan. A crucial part of asking is explaining how and when you plan to pay the money back. Many people make the mistake of promising to repay too quickly just to secure the loan. This can backfire if you’re unable to meet that deadline.

Be honest with yourself and with them. Look at your budget and figure out a realistic timeline. It is much better to promise a later date and meet it than to promise an early one and fail. Providing a clear repayment date shows you are in control of your finances and respect their money.

This also helps them with their own financial planning. Knowing when to expect the money back allows them to adjust their budget accordingly, preventing any strain on their end.

The Most Important Step is Paying Back on Time

Your actions after receiving the loan are what truly matter. Repaying the money as promised is the single most important step in this process. When your family lent you the money, they placed their trust in you. Upholding that trust is essential.

Make repaying this debt a top priority. If you happen to get the funds earlier than expected, pay the loan back early. This will leave a lasting positive impression and reinforce their belief in your reliability. Building a track record of responsibility will make them more willing to help you again in the future if a true emergency arises. This principle of honoring your word extends to all financial dealings, not just those with family.

What to Do if You Cannot Repay on Schedule

Life is unpredictable, and sometimes, despite your best intentions, you may not be able to repay the loan on the agreed-upon date. If this happens, do not avoid your family or ignore the situation. This will only create tension and damage trust.

The mature and responsible way to handle this is to address it directly and proactively. They are your family and will likely understand that problems occur.

- Communicate Early: As soon as you realize you might miss the payment date, let them know. Don’t wait until the day it’s due.

- Apologize and Take Responsibility: Acknowledge that you are breaking your promise. Explain the situation honestly without making excuses.

- Propose a New Plan: Don’t just state the problem; offer a solution. Discuss a new, realistic repayment date or suggest making smaller payments until you are caught up.

Facing the issue head-on, while embarrassing, is the best way to preserve your relationship and show that you are still committed to repaying your debt.

Frequently Asked Questions

What if my family says no to my loan request?

If they say no, accept their decision gracefully and without argument. They may have their own financial reasons you are not aware of. Thank them for considering it and explore other options, such as personal loans from a credit union or temporary side jobs.

Should we create a written loan agreement?

Yes, putting the loan terms in writing can be a great idea. A simple document that outlines the amount, the repayment schedule, and the date can prevent misunderstandings later on. This treats the loan professionally and shows you are serious about repayment.

Is it okay to borrow money from siblings instead of parents?

Borrowing from a sibling can sometimes be less complicated, but the same rules of respect and responsibility apply. Ensure you approach the situation with the same seriousness, have a clear purpose for the loan, and commit to a firm repayment plan to avoid straining your relationship.

How much is considered too much to ask for?

This depends entirely on your family’s financial situation. A good rule is to only ask for what you absolutely need and what you are confident you can repay. Never request an amount that would put a significant financial strain on them.

Leave a Comment