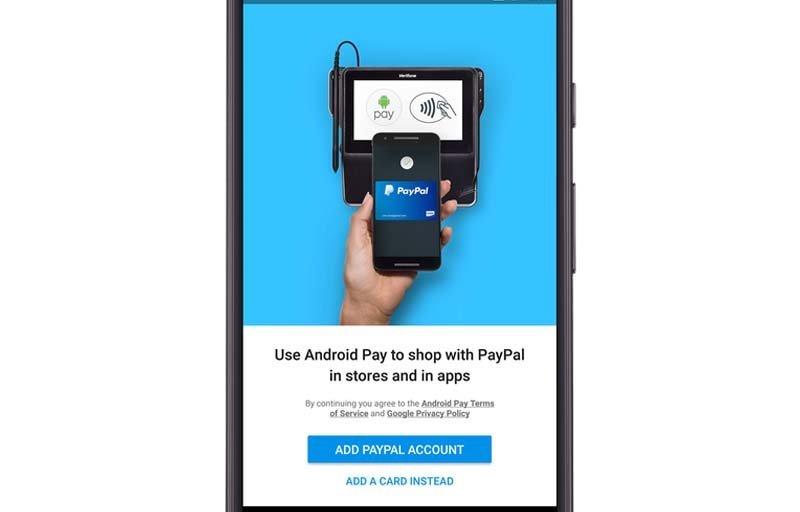

Android Pay and PayPal are joining in the United States to let people pay in stores and in Android apps using a linked PayPal account. The feature begins rolling out within a week, with a simple setup inside the Android Pay app. Google’s Pali Bhat said millions already use PayPal to shop and send money, and this move brings that speed to mobile checkout.

What the Partnership Means for Shoppers

The partnership connects PayPal’s large user base with Android Pay’s tap to pay system on Android phones. It helps people use the money they already keep in PayPal to pay in stores and inside Android apps without cards.

This move makes checkout faster and more flexible, because you can pay with a phone and choose PayPal as your source at the register or in apps.

- Use PayPal in stores that accept Android Pay with near field communication terminals.

- Pay in Android apps that already support Android Pay at the checkout screen.

- Keep purchases in one place with PayPal receipts and Android Pay transaction history.

Pali Bhat, Google’s global head of payment products, noted that millions already rely on PayPal for daily payments, which shows why this tie up can scale quickly in the US market.

How to Link PayPal to Android Pay

Setup takes a few minutes. You link your PayPal account inside the Android Pay app, then confirm your details. After that, you can tap to pay in stores and choose Android Pay with PayPal in supported Android apps.

- Open the Android Pay app on your Android phone.

- Tap Add a Payment Method, then choose PayPal.

- Sign in to your PayPal account and follow the prompts to link.

- Set PayPal as your default if you want to use it first at checkout.

Once linked, you can hold your phone near a contactless terminal to pay and pick PayPal at the app checkout when Android Pay is shown.

If you do not see the option yet, check for app updates and try again within the rollout window. You can switch between cards and PayPal at any time in the Android Pay app.

Rollout and Availability

The launch starts in the United States and is expected to reach users over the next week. Availability depends on updates to Android Pay and the PayPal app, so some users may see the option earlier than others.

| Region | Rollout Window | Where It Works | How You Pay |

|---|---|---|---|

| United States | Within One Week of Announcement | In Store and in Android Apps | Android Phone with Android Pay Linked to PayPal |

You will need a compatible Android phone with near field communication turned on to pay in stores and the latest Android Pay app to see PayPal as an option.

Merchants do not need to change terminals, since any store that accepts Android Pay contactless payments will work when PayPal is selected inside Android Pay.

Where You Can Pay and What Works

In stores, look for the contactless symbol or the Android Pay mark at the register. Hold your phone near the terminal and follow the on screen steps to complete the payment with your phone unlocked.

Inside Android apps, choose Android Pay at checkout when offered. You can then select PayPal as the payment source in the payment sheet. This helps you check out without typing card numbers or billing details.

The integration is designed to work anywhere Android Pay is accepted, so you get PayPal speed at many large and small retailers and across popular Android apps.

If you travel, remember this launch is focused on the US first. International support has not been announced in this update, so results may vary outside the US.

Privacy, Security and Fees

Android Pay uses tokenization, which means the store does not get your real card or PayPal account number. Your phone also needs a screen lock to pay in stores, adding another layer of protection.

For most consumers, PayPal does not charge a fee to make a purchase, and Android Pay does not add a fee for tap to pay. Your bank, carrier or data plan may have their own charges, so check your terms if you have questions on costs.

PayPal helps track purchases with receipts in your PayPal account, and Android Pay shows recent activity in the app. If you lose your phone, you can remove access through your Google account and change your PayPal password as a precaution.

Industry Context and Why It Matters

This move joins two large payment networks to cut friction at checkout. It aims to bring more people to mobile wallets by combining PayPal balance and bank funding with Android Pay tap to pay access in many stores.

Faster checkout can lift conversion in apps and reduce lines in stores, which helps both shoppers and merchants.

As mobile payments grow, simple setup and trusted brands are key drivers. This partnership checks both boxes, which is why many US users may try it as soon as the option appears in their apps.

FAQ

How do I use PayPal with Android Pay in stores?

Link PayPal inside the Android Pay app, then unlock your phone and hold it near a contactless terminal. Choose PayPal if prompted and wait for the confirmation on screen.

When will this be available on my phone?

The rollout is starting in the United States within a week of the announcement. Update Android Pay and the PayPal app and check again if you do not see the option yet.

Can I still use my cards with Android Pay?

Yes. You can keep cards and PayPal side by side and switch sources at checkout. Set your default inside Android Pay at any time.

Are there extra fees for paying with PayPal through Android Pay?

Consumers generally do not pay a fee for purchases with PayPal or Android Pay. Check your bank, carrier or data plan for any separate charges that may apply.

Is it secure to pay with my phone using PayPal and Android Pay?

Yes. Android Pay uses tokenization and requires a screen lock. Stores do not get your real PayPal or card number, and you can manage devices from your Google account.

Can I use this outside the United States?

The current launch is focused on the United States. Availability in other countries has not been announced in this update.

Leave a Comment